How To Set Up A Real Estate Investment Group

Start your own real estate investment group to benefit from investor expertise and relieve coin investing

Few investments accept created as much legacy wealth as real estate but few investors have the experience to know how to find the best backdrop. A real estate investment grouping tin help bridge the gap for individual investors and solve some of the biggest challenges.

I started investing in real estate in my early 20s, more often than not in single-family houses but also through my task every bit a commercial real manor agent. I had to learn everything about real estate investing the hard way…often at a pretty high cost.

Like the time I bought a house at a sheriff's sale and then had to fight for months in court to get possession…or all the times I didn't do a full check on tenants earlier letting them move in, only to lose months of rent when they trashed the identify.

The reply is in joining a real manor investment grouping, a society of other real manor investors that help each other sharing their experience and resources.

The problem for many investors is that existent estate investing groups can accuse monthly fees up to $100 which eats away at any return on the investment.

It'south easier than you recollect to starting time your own real estate investment club, benefiting from the power of the group simply saving money in the process.

It'southward the best of both worlds, stress-free real estate investing through the ability of a grouping just without the costs of joining a club with high dues.

Through this mail service, I'g going to show y'all how to start your ain real estate investment group and how to find the best deals. Information technology'south a long article only yous'll learn everything you lot need from how to find real manor investors for your club, how to notice real estate groups near you and even some tips on property investing I've picked up over the years.

What is a Real Estate Investment Grouping?

People spend their lives learning how to analyze and negotiate real manor deals. Real estate investment is no different than stock investing or any other opportunity with huge returns. Chasing these deals is a whole manufacture of analysts and real estate companies.

So how are regular people like you or me supposed to compete? How do we find the best deals and put together a real estate portfolio with a chance to succeed?

The reply is by forming a real estate investment group with other investors. There'south different forms your investment club can take from really pooling your money to purchase backdrop to just talking near how to detect rental investments. The common bond in all real manor investing groups is that you help each other compete against the large coin players to become the all-time returns.

Real estate investment groups do good by bringing together different people that tin all bring their expertise including investment analysts, accountants, lawyers, negotiating and closing specialists, and contractors.

Existent estate investment clubs used to be exclusively in-person, a grouping of five or ten investors getting together each calendar month. With social media and the cyberspace, there are just as many groups formed online equally live groups.

While in that location are options to join existing real estate investor groups, at that place are a few important reasons you may want to beginning your ain.

Starting Your Own Real Manor Investment Lodge

Almost of the existent estate sites you'll notice online are for-profit group tools, selling useless products and information to private real manor investment clubs. How it works is you do all the work, finding other real estate investors in your area and you pay monthly dues to the membership site.

They provide some tools and material only nothing yous can't find online for gratuitous.

It'due south much better to first your own existent estate investment order. Showtime, the for-turn a profit membership groups really don't provide anything but organization. You can find all the data online and for free. With five or more people in your real estate grouping, it actually won't fifty-fifty take that much for each person to find a couple of information resources.

Exercise the math and it just makes sense for most investors to start their own informal real estate investment group rather than pay dues to an existing club. Nigh clubs charge around $l a month which adds up to $600 a year and a drag of 2.4% on a portfolio of $25,000 in existent estate.

I'll list a few of my favorite real manor resources here and how I started my own existent manor investment grouping. Scroll downwards through the residue of the mail service for a step-past-step on real estate investment analysis, finding backdrop, existent estate strategies and how to avert the biggest problems.

I follow several real estate platforms to get admission to as many deals every bit possible. It costs nothing extra to have an business relationship on more than one real manor crowdfunding site and you'll be able to invest in more than deals.

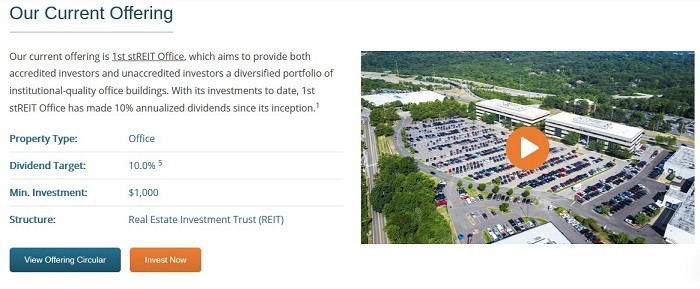

Streitwise is a unique real estate crowdfunding platform I've been following that is a new twist on REIT investing. Many of the crowdfunding sites are nonetheless only open up to wealthy investors but the Streitwise real manor fund is open to everyone.

The Streitwise 1st Streit Office REIT invests in loftier-quality office properties and every bit of the date of this video, has paid a 10% annualized dividend. The fund is managed by seasoned real estate professionals that have acquired or managed over $five.4 billion in holding and beyond all belongings types.

Learn more than about the Streitwise existent estate fund

National REIA – The National Real Estate Investors Association is about the only real estate group resource that I recommend. It's a non-profit organisation fabricated upward of investment clubs effectually the land so information technology'due south withal going to try charging membership. You might exist able to utilize it to detect other people in your surface area and and so form your own group without paying dues.

Craigslist – This is withal one of the easiest and complimentary ways to notice other investors interested in starting a club. Y'all tin also mail something at the local library or contact commercial real manor companies in your expanse to become connected with known investors.

REIT.com is the national organization promoting real manor investment trusts (REITs). It'southward obviously biased to REITs rather than straight ownership or real manor crowdfunding but still a adept source for information on real estate investing and trends.

Amazon Real Estate Category – you can get existent estate books on Kindle for just a few dollars, saving hundreds versus paying expensive monthly dues to real estate investment clubs. Read through a couple of books with your real manor guild and y'all'll have everything y'all need to get started.

There is one type of real manor investing y'all won't find much information almost from the traditional sources. Information technology's because the large players in real estate; the lawyers, holding brokers and other center-men don't want you to find information technology. It's chosen real estate crowdfunding and it's putting the power to build a real manor empire in your hands.

What is Real Estate Crowdfunding?

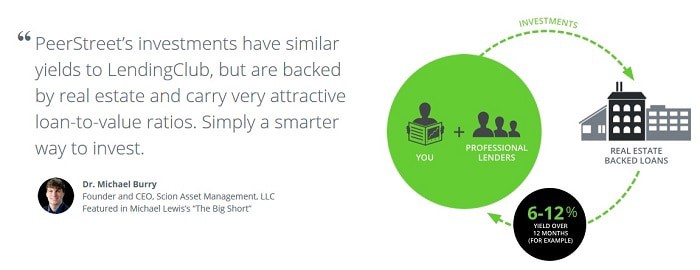

Crowdfunding can be cleaved into two types: rewards-based and disinterestedness crowdfunding. Rewards-based crowdfunding on websites like Kickstarter might give you lot prizes for your support of a campaign but you become no ongoing investment. Equity crowdfunding is where you really become an buying or bond on the company.

The collapse of the existent estate market place in 2008 took a lot of banks out of real estate investing. Even though few assets are as stable, banks just aren't lending to real manor developers like in the by.

Enter real estate crowdfunding.

Real estate crowdfunding is a type of equity crowdfunding. You are either loaning a real estate developer coin or investing in their project. You get a legal ownership of the property and returns, usually on a monthly or quarterly basis.

The new source of funds have been a huge relief to developers and are getting individual investors in on great returns that used to be simply attainable to the wealthy.

I'grand including existent manor crowdfunding here because information technology offers a lot of the benefits of starting your own existent manor club. The platform has staff and analysts that provide due diligence on projects including background checks on the developer. Investing in a project means you get professional management through the programmer.

Existent estate crowdfunding can also exist a great resources for a new order to await for deals and talk through property analysis.

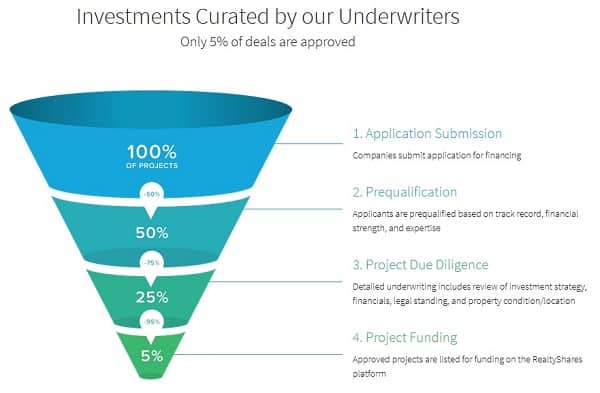

The fashion real manor crowdfunding works is that you sign up as an investor on portals like Streitwise and link your banking company account. The portal does a lot of the initial legwork for yous and only 5% of the applications for funding always brand information technology to the site. The platform checks the developer'south track record and fiscal documents every bit well as checks on the property before it lists deals on the site.

Strei t wise offers a hybrid investment between traditional REIT fund investing and the new crowdfunding. The fund is like a real estate investment trust in that it holds a drove of backdrop but more like crowdfunding in its direction. The fund has paid a 10% annualized return since inception and is a great way to diversify your real manor exposure.

There are several benefits to real estate crowdfunding versus traditional real manor investing:

- Invest every bit little every bit a few thousand in each holding. Y'all don't need to exist a millionaire to invest in several different properties or go into debt on existent estate loans.

- Invest in many unlike property types and locations to spread your run a risk. That means your wealth doesn't evaporate if one property or location crumbles.

- All the expertise and assistance of the real estate crowdfunding portal without having to sign risky partnership agreements with funding partners or builders.

Using existent estate crowdfunding to invest in properties means you don't have to spend the time scouting. You accept everything there on the platform. You tin assign one person from your real estate investment group to look at each available property for assay and so make up one's mind how it fits with your overall portfolio.

Real Estate Investment Strategies for Your Group

Before y'all outset investing in real estate, it will assist to understand the strategies that will reduce your risk and increment render. Equally with almost investments, success is all about diversification.

With real estate, you get different types of diversification in belongings blazon, location and with debt or equity investments.

- Debt versus equity investments

- Existent estate in different cities and regions

- Different holding types including residential, office, retail, industrial and storage

Your real estate investment group tin can help decide where and how you want to invest. It'due south a good idea to invest in properties across at least a few different cities. They say existent manor is nigh location, location, location and where y'all invest can mean a big difference in return. Investing in a few dissimilar cities makes sure yous do good from economic growth beyond the country.

Y'all can invest in real estate loans besides as have an equity ownership in properties. Debt investments offer more security because it's a lien confronting the property with a set rate of render. Equity investments are riskier but offering more upside return on price appreciation.

The mix of debt and disinterestedness in your portfolio is largely a matter of your age and how much risk yous can tolerate in investments but I would recommend around 65% equity and 35% debt for almost investors with a decade or more to retirement.

Ane of the best uses of a existent estate investment grouping is the ability to gather investors that know more than most specific types of real estate. Types of holding can include raw land, single-family or multi-family residential, function, retail, lodging and industrial. Each blazon of property has unlike render and risk characteristics and it's really helpful to take an expert in each inside your real estate gild.

The majority of deals listed on crowd platforms take been residential properties, split between equity and debt deals. This is pretty common beyond most existent estate crowdfunding portals because residential developers have had the hardest time getting bank loans.

Finding Investment Property for Sale

Finding real estate investment property alone will take weeks of online searching, site visits and negotiation. I used to spend a couple hours a calendar week talking to different real estate agents and brokers just sourcing deals.

The internet and existent estate crowdfunding has made the process a lot easier. I would suggest assigning each person in your real estate investment group a different website to follow for deals unless they have another specific talent like legal or investment assay.

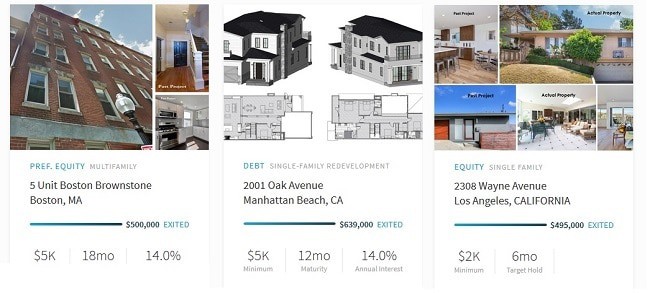

On Streitwise, you discover the investment offers by clicking 'Explore Investments'. Investments are either Preferred Equity, Disinterestedness or Debt.

Each investment offers detailed information on the property, financials, a market summary, overview and management also as a download of documents. Virtually investments come up with all the assay yous'll need to make your decision but make certain you lot back it upwards with some of your own inquiry.

Acquire more about the Streitwise real estate fund

Finding other Real Manor Investors for Your Grouping

New real estate investment clubs will face a dilemma, detect enough investors to make the group's activities worthwhile but beingness selective enough to only recruit engaged members.

Sympathise that you don't need dozens of group members, especially if you plan on keeping the club informal, but members practise need to be engaged enough that they contribute to combined knowledge.

I've seen a lot of clubs but let anyone come to meetings. What happens is that people come for a few meetings, soak upwards all the information they need and and so y'all never see them again.

To keep members and grow the club's combined noesis, you need to actively recruit members and candidates need to contribute before they become total members.

- Finding potential members is a matter of current members becoming champions of the grouping. First with two or iii members and work out a pitch each of you lot tin can make at social events and existent estate-related networking.

- The guild should have a formal awarding procedure that gathers background information and experience on candidates. This should include a criminal background cheque and will be paid for out of an application fee. The first time y'all turn a con artist away, you'll exist glad you spent a little on the application process.

- Candidates tin can attend a couple of meetings just then demand to complete a project to demonstrate their value to the group. This can be as simple every bit a 20-infinitesimal presentation on something that will benefit the grouping.

This doesn't mean you can't accept new real estate investors with little experience. They can notwithstanding contribute to the group. Choice a new topic in real estate investing, a new trend or financing method that possibly the group doesn't know much about notwithstanding, and assign it to the candidate for a presentation.

Even informal real manor investment clubs need to appoint officers and collect ante. At a minimum; you'll demand a president, somebody to take meeting notes and somebody to manage the club bank business relationship. Even collecting $x a month as dues can pay for speakers, courses or club events.

Existent Manor Investment Club Activities

Club meetings demand a purpose across just, "talking nigh real estate investing." A group of investors but getting together informally to share stories and tips volition quickly go off rail, people will get bored and membership will drop to aught.

That doesn't mean you tin't start the meetings with an breezy 'what'southward new' just have something planned each meeting that volition increment the group's combined knowledge.

Inviting speakers to talk is a cracking way to get outside expertise and a lot of local professionals will agree to nowadays for free if your group is large enough.

Courses paid through fellow member dues can be a great mode of keeping upwardly with new trends and getting new skills. Become one license for an online course and hook your laptop up to the Television set. Print out the form materials for everyone and make it a shared learning experience.

Workshops are similar courses except normally alive and over only a few days. These are going to be more than expensive than just getting i course for everyone but work out a discount for the group to attend together.

Club partnerships can be some of the best real manor investments yous make. The club I'm in is informal and we keep our investments separate for the most part but will pool some funds for a property every once in a while. There are extra legal bug and risks with this kind of engagement simply it can get you access to bigger investments and really solidifies the group.

Legal Bug to Starting a Existent Estate Investment Group

Virtually existent estate clubs remain informal and do little more than sit around talking well-nigh investments. The best clubs are legally incorporated and have a more formal construction. This doesn't mean spending thousands on paperwork or lawyers. You can incorporate a lodge and depict upwardly all the documents for less than a few hundred in most states.

Yous might decide to stay informal for a year or until y'all build a core of engaged members. Once you have 10 or twenty members that are meeting regularly, it's time to start thinking about a formal structure and officer roles. This may seem like a lot of work but a formal social club can do so much more than just a rag-tag grouping.

The club shouldn't demand insurance unless it's creating its own courses or formally advising investors. If whatsoever of the members have a co-investing partnership, they'll need all the regular liability and property insurance that comes with the real estate investing.

How to Do Existent Estate Investment Analysis

I started after college equally a commercial real estate analyst and even so do freelance analysis for a few belongings developers. Finding good real estate investments isn't like researching stocks only that'due south a good affair.

Where investors scramble for a couple percentage actress return on stocks versus the marketplace, put together a solid process for real estate investment analysis and you tin easily make double-digit returns each year.

Direct real estate investment is far from a passive income strategy though it can be a dandy business concern and can boost your returns through sweat disinterestedness. Investing indirectly in REITs removes a lot of the management hassles but likewise reduces the returns. Investing in crowdfunding real estate can be a happy medium with not bad returns but managed properties.

Real estate analysis starts with researching the market, the city or region where the property is located. A lot of this is going to be included in the investment proposal on existent estate crowdfunding sites but make sure yous double-check the numbers.

- What are the growth factors for the property? For residential, this will exist things similar population growth and employment. For commercial property, it could exist factors similar retail sales growth and employment in related industries.

- How much building has been completed or planned over the last five years compared to longer-term averages? This is extremely of import considering real estate developers love to overbuild when times are adept only to see vacancy rates spring years later.

- How fast take prices for different belongings types increased over the terminal few years?

- What percentage of personal or commercial loans have defaulted over the concluding few years compared to long-term averages? Loan defaults tend to get-go ascension earlier a market crash and are a great bespeak to investors.

Once y'all've found a couple of adept markets for investment, you can beginning looking at individual property. Once again, well-nigh real manor crowdfunding deals volition have detailed analysis in the documents but someone in your real estate investment group should be tasked with checking the numbers.

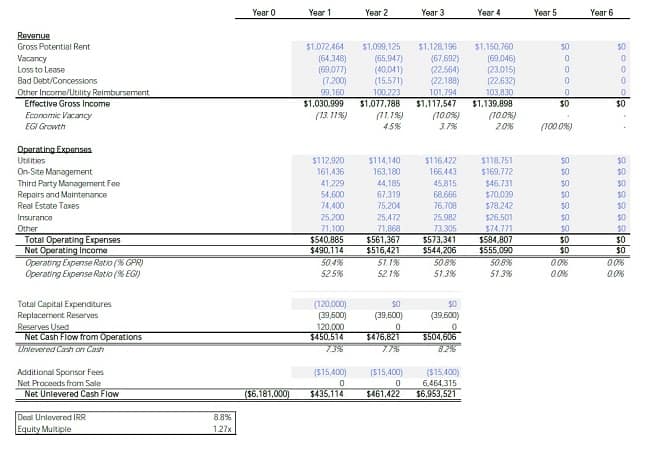

At minimum, start with an guess of rental income over the side by side three to five years. Are the developer'south estimates for vacancy and lease losses similar to your market inquiry?

Expenses can range from 20% to 70% on real estate depending on the blazon of lease with tenants. If tenants pay what's chosen a triple-cyberspace lease, meaning they pay nigh all expenses, then costs for the developer and investors will be much lower merely the rent collected won't be as loftier.

Not-greenbacks aspects of real estate investment tin exist some of the most important aspects of your assay. Depreciation is a huge benefit for real manor considering information technology reduces the amount of taxes paid on rental income. You also want to account for a maintenance reserve by setting aside money each year.

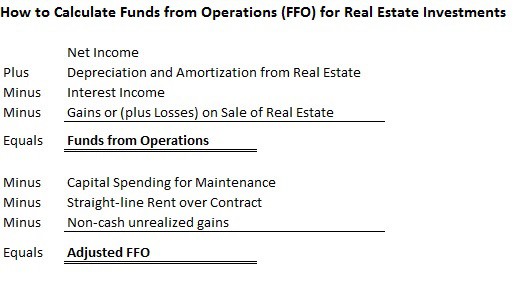

The near important measure in real estate investing is Funds from Operations (FFO). It volition help you lot empathise the cash generating potential and brand certain you lot aren't paying also much for a property.

FFO is found past reducing your rent by all greenbacks expenses only adding back any depreciation you deducted for taxation purposes. You also need to deduct interest income and gains or losses on sales if you are analyzing a portfolio of properties.

You tin can also use the adjusted FFO past deducting maintenance reserves and any rent paid merely not earned yet.

With the FFO or AFFO, you lot can compare the cost of an investment property against other deals. For example, a property priced at $3 million and producing $300,000 annually would be 10-times FFO. Information technology's an of import measure out of value for real manor investing.

You can use the FFO measure even if you are investing indirectly through real manor crowdfunding. Measure out the price-FFO the developer is expecting to pay on the holding or on the consummate development to come across if they are getting a expert deal. A programmer in over their head and paying too much for properties isn't someone with whom you want to invest.

How to Invest in Existent Estate on Streitwise

Streitwise has a thorough screening process for investments on the site. A programmer must first pass checks on financial strength, expertise and their runway record for making a property profitable.

The existent estate crowdfunding portal then goes through a detailed underwriting procedure to look at the specific property. They review the investment strategy, legal ownership of the address and property condition.

This level of analysis means that simply 5% of the real estate deals submitted to Streitwise ever brand it to funding. Once a holding passes through the funnel, information technology is listed on the portal where investors can do their own analysis and decide if they want to invest.

There are dozens of properties bachelor on the dissimilar crowdfunding sites, more than than one investor may be able to expect at every month. This is where your real manor investment group comes in handy. Each person in the investment gild may be assigned a different website to watch deals or a different part of the analysis to limit the burden on any 1 investor.

Investment deals on the site range from short-term (eighteen months) to several years and can include either debt or disinterestedness investment. The annual interest rate is provided for debt investments while a projected return is provided on disinterestedness deals.

Returns vary by type of bargain and time horizon. Practise your own analysis though because these rates of return are not set in rock and could alter. Most all deals permit the developer to extend the fourth dimension on the investment.

Until this twelvemonth, existent estate crowdfunding was only available to accredited investors with household income over $200,000 annually or $1 million in net worth. That all changed when the SEC revised rules around the JOBS Act and at present regular investors are getting in on the opportunity.

Opening an account on Streitwise takes less than a few minutes and is completely free. You won't need to enter your banking company account information unless y'all decide to invest but it helps to be ready if an investment comes along.

- Create an business relationship with your e-mail, countersign and contact data.

- Consummate the accredited investor questionnaire by checking either the box for internet worth or income. Yous won't exist able to run across investments unless you complete this section.

- Enter your banking concern business relationship number and routing number.

- Verify your e-mail address to start the business relationship.

After opening the account, you can run across all the detail on each existent manor offer by clicking 'Explore Investments'. If yous desire to offset investing immediately, you'll need to complete a suitability questionnaire. Otherwise you'll have to wait 30-days before investing.

This is why I recommend opening an account at present fifty-fifty if you're not gear up to invest yet then that the thirty-day 'cooling-off menstruation' can pass before you're ready.

How to Find Real Estate Investors Well-nigh Me

The internet is a huge resource for real manor investors only most miss out on the real benefits. Instead of confining yourself to just 1 local real estate investment group, bring together a few dissimilar online clubs with people in the real manor markets where yous want to invest.

This is going to go y'all real, ground-level experience and data directly in the cities where yous invest. We've already seen that ownership pieces of backdrop across the country is the best strategy for diversification.

By joining a few online existent manor groups, you get more data to use when deciding whether to invest in deals.

A few cities and states stand out as particularly popular for real estate investment groups.

I have been agile in real estate clubs in Florida, Los Angeles and Texas. I've also heard that Portland is a practiced city for existent estate investing. I think California is a popular real manor investing destination overall only the less expensive markets like Texas and Florida may be better for investors.

Some California real estate investment groups y'all might want to check out if you're in the area include: Bay Area Real Manor Moguls, LA Southward REIA, Los Angeles and Asian REIA and the Orange County Real Manor Forum.

Some Texas real estate investment groups y'all might desire to check out if you're in the area include: Dallas Real Manor Investment Grouping (REIG), Dallas REI Meetup, E Texas Real Estate Investors (ETREI) and the Realty Investment Club of Houston (RICH).

Some Florida real estate investment groups you lot might want to check out if you're in the area include: Central Florida Realty Investors Association (CFRI), Florida Gulf Coast REIA, Miami Real Estate Investors Clan (MREIA) and the Tampa Bay Existent Estate Investors Association.

Common Real Estate Investing Problems

I've seen my share of real estate investing problems, some of which tin can exist reduced past investing in crowdfunding real manor while others are only a mutual hurdle of the investment.

Real Estate Investing Error #one: Bad Neighborhoods and Bad Tenants

The biggest trouble I had when renting out single-family unit houses was tenant turnover and the cost of rehabbing a house each time a tenant left. I made the mistake of thinking I could buy houses in lower-income neighborhoods for cheap and nonetheless get skilful hire.

I ended up having to evict tenants constantly for non-payment and would spend thousands a year fixing backdrop upwards to put the houses back on the marketplace.

This kind of management headache isn't a problem with real estate crowdfunding because someone else is managing your portfolio but it's even so an of import part of your property analysis. Do y'all fifty-fifty want to invest in properties that are non in neighborhoods that volition attract quality tenants?

You tin can make money renting in whatsoever neighborhood but y'all need to sympathize what you're getting into first. Start real estate investing only in actually good neighborhoods before you examination your luck in others.

Existent Manor Investing Mistake #two: Not Understanding Allow Costs

Permit and license costs are not generally a trouble if you take adept tenants. The problem comes up when your tenants continuously trash the firm and the belongings. That ways metropolis inspectors are going to be sending you lots of public nuisance letters for cleanup.

If you live in a county that requires a rental license on properties, you'll as well need to make certain each rental is upwards to lawmaking for the annual inspection. Bad tenants will send your annual rehab costs through the roof as you supplant screen doors and windows, paint, smoke detectors and every little defect they caused over the year.

Real Manor Investing Fault #3: Depression initial cash menses

If you are buying houses with loans, you probably are non going to meet much cash flow from real estate investing for quite a few years. More than than likely, yous will need to pay out of pocket for repairs and other expenses.

Estimating expenses is where a real estate investment group comes in handy. It is adequately piece of cake to budget for the monthly mortgage merely expenses tin can take hold of you off-baby-sit quickly. Budget for at least ten% vacancy and upwards to 20% of the gross rent going to expenses. It's always a expert idea to take a cash fund set bated to cover unforeseen expenses.

Real Estate Investing Mistake #4: Lack of Diversification

Not having a range of property types or investing in more than than one location is probably the biggest existent estate investing mistake made by regular investors. Direct ownership of properties is just too expensive for well-nigh people to consider buying a portfolio of real estate assets.

Only buying different property types; i.e. residential, office, retail, and industrial is disquisitional to surviving real estate crashes. Residential property is relatively stable through economic recessions compared to office and retail holding. Commercial holding tends to pay higher returns but can be more volatile.

Across spreading your risk across holding types, you don't desire to expose yourself to just one metropolis or region. States like Michigan and Ohio were real estate gold up until the 1980s just weakness in manufacturing has hitting the area hard. The oil boom has led to a surge in Texas real estate investing simply issues arise every fourth dimension oil prices sink.

The best manner to diversify your existent estate portfolio is through indirect buying with real estate crowdfunding sites. I would recommend investing in at to the lowest degree three different property types and in at least three to v states.

Real Estate Investing Error #5: Getting Lazy with Existent Estate Analysis

One of the biggest investing mistakes for indirect real estate investors is just getting lazy with their due diligence and assay. The real estate crowdfunding portals do a lot of the legal work for you only that doesn't exempt you from doing your ain homework.

This is where a real estate investing club can really aid, especially if you lot have some accountants, lawyers and investment analysts in the group. Brand sure you particular annual costs and leave a buffer for unexpected expenses. Don't assume a high rate of toll appreciation on your backdrop and keep a minimum render in mind when yous are negotiating the purchase.

I would recommend you lot be extremely conservative in your analysis. Presume a high vacancy rate and regular expenses on the property. Over the long-run, price appreciation is only going to add a pct or ii to the return afterward inflation. If a property does not look like it volition return at least ten% on these conservative estimates, I wouldn't fifty-fifty consider it for investment.

Summary: How to Start a Real Estate Investment Group

- Look for other real estate investors online or through agents

- Assign each investor a existent manor sector to follow, i.e. role, storage, retail, industrial.

- Learn how to analyze real estate investments

- Invest in dissimilar property types and across different locations

- Invest in debt and equity real estate investments

- Consider real estate crowdfunding for easier management

Is a Existent Estate Investment Group Right for You?

Everyone should have some real manor investment in their nest egg, whether information technology'due south through direct buying or some form of indirect investment. Existent estate isn't equally volatile as stock prices merely provides a meliorate return compared to bonds. Combined with a stock and bond portfolio, existent estate volition help you run across your investing goals and reduce the ups-and-downs of investing in financial assets.

While existent estate investing should exist a part of everyone's fiscal program, participating in a real manor investment group may not be for everyone. Like any kind of group, existence in a existent estate club volition take time and not all members will pull their weight. The upside is that these groups can be a huge resource to get started and tin can aid reduce the time brunt that comes with researching properties.

Learn more almost the Streitwise real manor fund

Real estate investment groups tin can exist excellent resources for new investors and tin be some of the best friendships y'all make. Don't experience like you lot need to bring together an existing existent estate club or that you demand to pay ante to the grouping. Put together your ain real estate investor network to benefit from the shared feel and follow some of the points in this commodity for guidance.

How To Set Up A Real Estate Investment Group,

Source: https://financequickfix.com/real-estate-investment-group/

Posted by: creasmanfrombleasome.blogspot.com

0 Response to "How To Set Up A Real Estate Investment Group"

Post a Comment